Digital banking belongs to the wider context for the relocate to electronic banking, where financial solutions are delivered over the web. The shift from traditional to digital banking has actually been steady and stays recurring, and also is constituted by varying degrees of banking solution digitization. Digital banking entails high levels of process automation as well as web-based services as well as may include APIs allowing cross-institutional service make-up to provide banking products as well as provide transactions.

An electronic bank stands for a digital process that includes online financial and also beyond. As an end-to-end platform, electronic financial should include the front end that customers see, the backside that lenders translucent their servers as well as admin control board and also the middleware that connects these nodes. Ultimately, a digital bank must help with all useful levels of banking on all solution shipment systems.

The reason electronic banking is greater than simply a mobile or on-line system is that it includes middleware remedies. Middleware is software application that bridges operating systems or data sources with other applications. Monetary sector departments such as danger monitoring, item advancement and also marketing must also be included in the center and backside to genuinely be thought about a full electronic financial institution.

Nib International Financial institution is dedicated to operation under the transforming infotech. In this respect, numerous software application solutions were Internally created. Among which; software that makes sure a safe intra workplace communication platform is applied. Supply Administration System as well as Signature Capture as well as Access System are under application. Additionally, a Queue Administration enhancement for the fx application.

As the internet arised in the 1980s with early broadband, electronic networks began to link stores with distributors as well as consumers to develop needs for early on-line brochures and also stock software systems. By the 1990s the Web ended up being extensively readily available and also on the internet financial started ending up being the standard. The enhancement of broadband and ecommerce systems in the very early 2000s led to what resembled the modern digital banking world today.

Over 60% of customers currently utilize their smartphones as the favored method for digital financial. The challenge for financial institutions is currently to help with needs that connect suppliers with cash via channels established by the customer. This vibrant forms the basis of client complete satisfaction, which can be supported with Consumer Relationship Administration (CRM) software.

There is a demand for end-to-end uniformity as well as for solutions, enhanced on comfort and also user experience. The marketplace offers cross system front finishes, enabling acquisition decisions based upon offered modern technology such as smart phones, with a desktop or Smart TV at residence. In order for banks to satisfy customer demands, they need to keep concentrating on enhancing electronic modern technology that provides agility, scalability and also efficiency.

Only 16% emphasized the possibility for cost conserving. Major benefits of electronic financial are: Business effectiveness - Not only do digital platforms enhance communication with customers and also deliver their needs faster, they additionally offer methods for making internal features more efficient. While banks have gone to the center of digital modern technology at the customer end for decades, they have not completely embraced all the advantages of middleware to accelerate performance.

Traditional financial institution processing is costly, slow and also prone to human error, according to McKinsey & Company. Depending on people as well as paper likewise occupies office, which runs up energy and also storage space costs. Digital systems can future decrease prices online banking solutions via the harmonies of more qualitative information and also faster reaction to market adjustments.

Combined with lack of IT combination between branch and also back workplace personnel, this problem minimizes business efficiency. By simplifying the verification process, it's easier to apply IT options with company software, resulting in even more exact bookkeeping. Financial accuracy is important for financial institutions to conform with government policies. Enhanced competitiveness - Digital solutions aid manage marketing listings, allowing financial institutions to reach wider markets and build closer connections with tech savvy consumers.

It works for executing client rewards programs that can enhance commitment and also complete satisfaction. Greater agility - Making use of automation can quicken both outside and inner processes, both of which can boost client satisfaction. Complying with the collapse of economic markets in 2008, a raised focus was put on risk management.

Improved protection - All services big or small face an expanding number of cyber threats that can damage online reputations. In February 2016 the Internal Revenue Solution introduced it had actually been hacked the previous year, as did several huge tech firms. Financial institutions can take advantage of additional layers of protection to secure information.

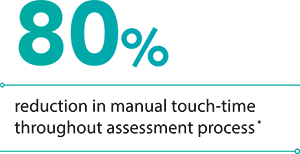

By changing hand-operated back-office treatments with automated software application solutions, financial institutions can decrease staff member errors as well as accelerate processes. This standard shift can lead to smaller sized functional systems as well as permit managers to focus on boosting tasks that require human treatment. Automation minimizes the demand for paper, which inevitably winds up taking up space that can be inhabited with innovation.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

61299117100

https://www.sandstone.com.au/en-au/

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA