Whether it is personalized material on your social media sites feeds, advising Alexa to alter the song or making use of FaceID to access to encrypted information on your cell phone, Artificial Intelligence (AI) is something we can no more neglect and also sometimes, we can not picture living without it.

In this write-up, we will certainly discover how technological advances as well as electronic improvement is urging an AI-enabled future in monetary solutions.

It is impossible to talk about the function of AI in economic services without highlighting that 2020 was extremely interfered with by COVID-19 as well as the ripple effect is anticipated to last for many years. Financial Institutions electronic improvement methods previously specified for 2020 quickly unwinded, subjecting the inefficiencies to respond and also react rapidly when the pandemic gripped the globe at an unprecedented rate. The reality is AI is encountered by most individuals broker data from morning until evening.

There has been dispute over real definition of AI as the expectations on whaAI Robot-1t is deemed as ' actual intelligence' change so often. At a top-level, AI as a field can be referred to as any type of strategy that makes it possible for makers to solve a task like how human beings would certainly.

Maybe leveraging Machine Learning, which uses formulas to enable computers to learn from instances without requiring to be clearly configured to choose; or Natural Language Processing, which is focused on producing meaning and also intent from text in a readable, natural type, or Computer Vision, which is concentrated on drawing out definition and intent from visual aspects including pictures and also video clips.

Accelerated digital improvement

The rise of fintech and brand-new modern technologies over the last years has actually been substantial as well as this has affected how consumers engage with organisations as well as consequently has actually changed the financial solutions landscape. Changing customer assumptions, tough competitors, enhancing governing stress and also the strain to improve functional efficiency has actually seen the market force itself into a reactive process where rate to market came to be much more vital for survival. A new era of open financial has enabled systems to quickly and also flawlessly incorporate with new platforms and also applications. Physical financial institutions and paper systems are rapidly being obsoleted as well as changed by durable digital ecosystems, evident by the enhancing introduction of new electronic only challenger financial institutions.

Digital improvement simply put is to reconsider what we currently produce based on brand-new modern technologies readily available. It is the process of modernising what we have actually done prior to. A digital change technique should customize an organisation's feedback to crises, changing consumer behaviour, and also more comprehensive market problems. It is right here that AI can absolutely be leveraged.

Role of AI - Online Assets_4

AI quality in financial services

Financial organisations are investing massive amounts of capital in digital capacities such as chatbots, expert system (AI) and open APIs. The primary developments over the past sixty years have actually been advances in search algorithms, artificial intelligence algorithms, and also incorporating analytical analysis right into understanding the globe at large. The favorable influences that AI is having on economic solutions is expanding.

Making use of AI in credit rating decision-making has become significantly typical, with the prospective to make quicker a lot more accurate credit decisions based upon an broadened collection of offered information. AI-assisted underwriting provides a 360-degree view of an candidate. It draws together huge and also traditional data; social, service as well as internet data; and unstructured information.

AI is playing important function in scams prevention by helping to analyse client behaviour to expect or identify deceitful acquisitions. Making use of a maker learning-based scams detection service could be trained to spot fraudulence within more than one type of deal or application, or both of these at the same time.

Much of the talk about AI in banking has had to do with just how innovation can change some functions presently executed by humans. Nevertheless, AI could additionally help monetary organisations serve their consumers more effectively by giving them less complicated access to relevant information.

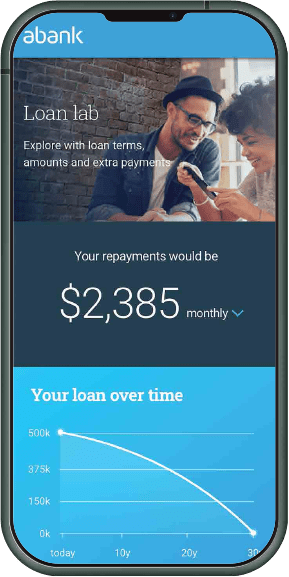

It is assumed around 50% of hand-operated work could be automated. These duties generally consist of physical activities in very predictable and also structured environments, as well as information collection and also information handling. Process automation is widely valuable for monetary service clients as their account applications, consisting of lending and also saving, can be sped up drastically.

According to Goldman Sachs, artificial intelligence as well as AI will enable ₤ 26 billion to ₤ 33 billion in yearly "cost financial savings as well as brand-new earnings possibilities" within the monetary industry by 2025.

Barriers to adoption of AI in financial services

Numerous business and also sectors delay in AI fostering. Developing an AI strategy with plainly specified advantages, finding skill with the suitable capability, conquering useful silos that constrict end-to-end deployment, and lacking ownership as well as dedication to AI on the part of leaders are amongst the barriers to adoption usually cited by execs.

Lacking a culture of innovation-- stakeholders within organisations hold enormous power in the success of AI jobs. Many economic organisations have small risk appetites this is infiltrated magnate on the ground in charge of IT transformation tasks. When it comes to skill, training as well as upskilling are crucial. Yet this shouldn't be simply concentrated on the technology groups. Organization teams also require to be upskilled in the art of the possible when it comes to AI, in addition to several of the downsides and also various other factors to consider.

Information framework - monetary solutions firms typically endure as their data is typically siloed across multiple modern technologies and also groups, with logical abilities typically focused on specific usage cases. The demand to standardise information and guarantee data is accessible is essential.

Data personal privacy and also cyber protection - using individual info are important concerns to resolve if AI is to understand its potential. The General Information Security Policy (GDPR), which presented a lot more stringent permission requirements for data collection, provides individuals the right to be failed to remember and also the right to object which is a favorable action in the ideal direction. Cybersecurity and frauds that could adjust perpetrate large fraudulence are likewise a issue.

Scrutinised expenses - Prices in AI jobs are frequently scrutinised by financing as well as elderly leaders as the initial ROI is low. AI capacities are long-lasting critical investments so higher returns would certainly be expected additionally down the line.

AI presents technological chances like no other. Let loose from the orbit of science fiction, this is a real-world modern technology that is ready to be carried out in any business-- today.

The capabilities of AI innovations will certainly remain to grow significantly as substantial data collections required for training AI solutions come to be a lot more easily accessible. The moment to go on AI is now. Low obstacles to entrance will bring ever before fiercer competition for AI ability, AI patents and AI capabilities.

AI embraced early will change the method banks arrange, run, speed up and also attain development. By implementing brand-new cutting-edge technologies, financial organisations will endeavour to decrease prices and develop far better experiences for clients and workers alike. This calls for organisations to completely reassess their general organization operations including their labor force, a social change is required to embrace new means of working and also technologies.

The uses and also abilities of AI continue to expand and alter everyday. This short article highlights essential aspects as well as benefits to be thought about and additional expedition is encouraged. AI must not be taken a organization device or expansion of modern technology yet rather as a transformative cultural adjustment that requires to be taken into consideration in a extremely broad, multi-dimensional context.